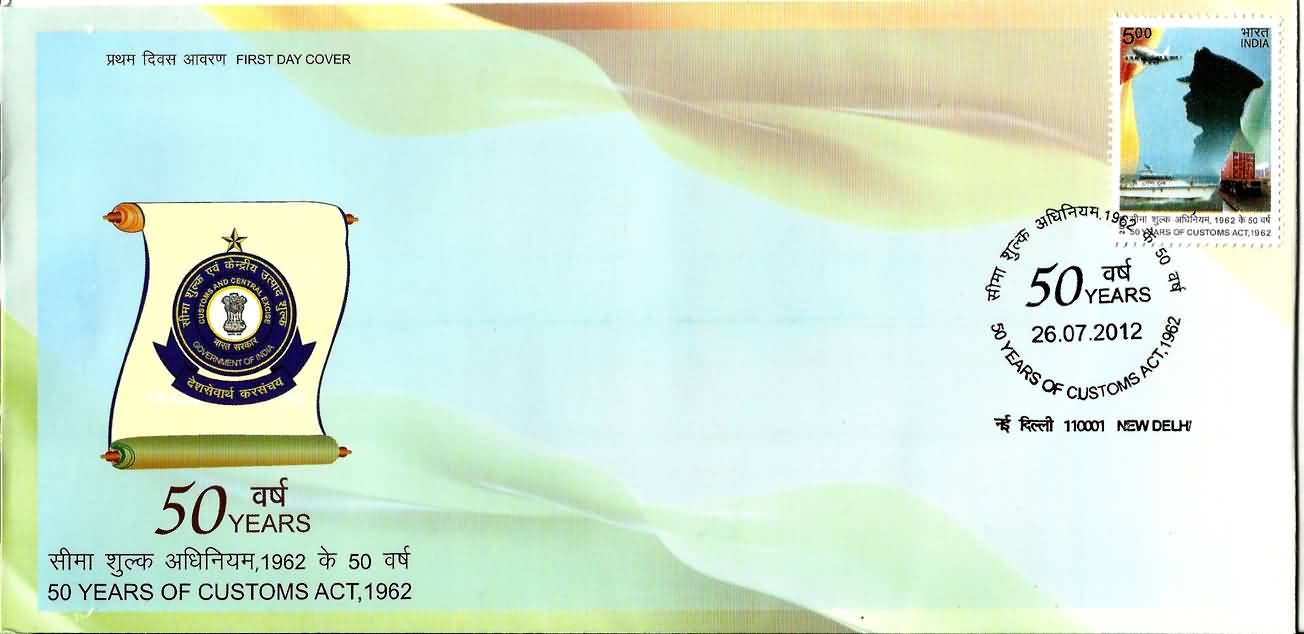

50 Years of the Customs Act, 1962

Technical Data

| Date of Issue | July 26, 2012 |

|---|---|

| Denomination | Rs. 5 |

| Quantity | 450,000 |

| Perforation | 13 |

| Printer | India Security Press, Nashik |

| Printing Process | Photo Gravure |

| Watermark | No Watermark |

| Colors | Multicolor |

| Credit (Designed By) | Smt. Alka Sharma |

| Catalog Codes |

Michel IN 2662 Stamp Number IN 2586 Stanley Gibbons IN 2884 WADP Numbering System - WNS IN025.2012 |

| Themes | Aircraft | Anniversaries and Jubilees | Aviation | Motorboats |

Historical Background of Customs in India

The concept of customs duty in India dates back to the 3rd Century BC, with references found in Kautilya’s Arthashastra. During the British era, customs-related laws evolved through enactments such as The Sea Customs Act, 1878, The Inland Bonded Warehouses Act, 1896, The Land Customs Act, 1924, and The Aircraft Act, 1934.

After independence, the need for a comprehensive and unified customs law led to the consolidation of The Sea Customs Act, 1878 and The Land Customs Act, 1924, resulting in the enactment of the Customs Act, 1962. The Act was notified on 23rd January, 1963 and came into force on 1st February, 1963.

Role of Customs After Independence

In the initial years after independence, customs duty rates were kept high to protect and promote domestic industries. Along with high tariffs, non-tariff barriers such as restrictions and prohibitions under the Export-Import Policy were imposed. As a result, customs revenue remained relatively low during this period.

With economic liberalization, customs policies were gradually reformed. Duty structures were rationalized, procedures were simplified, and trade facilitation was emphasized. Today, Customs is the second largest contributor among indirect taxes to the national exchequer.

Expanding Responsibilities of Customs

Beyond revenue collection, the Customs administration plays a crucial role in:

- Facilitating global trade

- Ensuring compliance with fiscal and non-fiscal laws

- Safeguarding the economic frontiers of the country

Customs officers actively detect and prevent commercial frauds and smuggling at ports, airports, land customs stations and inland container depots.

Technology and Trade Facilitation Initiatives

Over the years, Indian Customs has embraced technology and modern practices to enhance efficiency and transparency. Key initiatives include:

- Self-Assessment

- On-site Post Clearance Audit

- Authorized Economic Operator (AEO) Programme

- Accredited Planned Programme

- Customs Tariff Interactive Website

- Single Window Project for faster clearance of international goods

The Customs Electronic Data Interchange (EDI) System, operational at 108 locations, ensures expeditious and transparent clearance of goods. The ICEGATE portal connects Customs with ports, custodians, banks and other stakeholders, enabling seamless electronic exchange of information.

Global Recognition and Capacity Building

Indian Customs is internationally recognized for its robust Risk Management System, introduced in 2005, and its expertise in valuation databases. As a member of the Policy Commission of the World Customs Organization (WCO), Indian Customs plays a significant role in representing the interests of the Asia-Pacific region.

The National Academy of Customs, Excise and Narcotics (NACEN), a WCO-recognized training institute, is actively involved in capacity building and training of customs officers from India and abroad.

Commemorative Postage Stamp

To mark the completion of 50 years of the Customs Act, 1962, the Department of Posts is pleased to issue a Commemorative Postage Stamp, celebrating the enduring contribution of the Central Board of Excise and Customs in revenue mobilization, trade facilitation and protection of the nation’s economic interests.

First Day Cover

Leave a Comment

You must be logged in to post a comment.