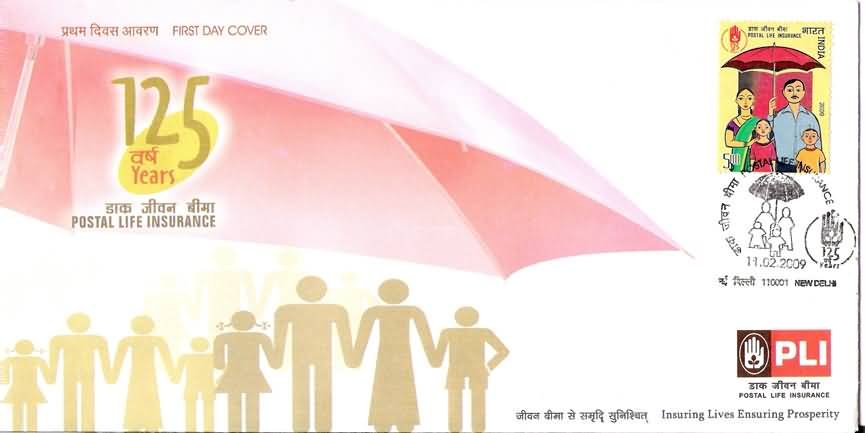

125th Anniversary of Postal Life Insurance

Technical Data

| Date of Issue | February 11, 2009 |

|---|---|

| Denomination | Rs. 5 |

| Quantity | 800,000 |

| Perforation | 13¾ |

| Printer | Security Printing Press, Hyderabad |

| Printing Process | Wet Offset |

| Watermark | No Watermark |

| Colors | Multicolor |

| Credit (Designed By) | Shri Kamleshwar Singh |

| Catalog Codes |

Michel IN 2351 Stamp Number IN 2314 Yvert et Tellier IN 2116 Stanley Gibbons IN 2576 WADP Numbering System - WNS IN013.2009 |

| Themes | Anniversaries and Jubilees | Families | Insurances | Umbrellas |

125 Years of Trust and Service

Postal Life Insurance (PLI) is the oldest life insurance scheme in India, established as a welfare measure for postal employees during the British era. Its origin lies in a humanitarian response to the tragic death of a postmaster in Bengal in the early 1870s, which left his family destitute. The incident moved the postal authorities to create a structured insurance mechanism to safeguard employees and their families.

Birth of the Scheme (1884)

The foundation of PLI was laid by F. R. Hogg, then Director General of Post Offices in India. Through Circular No. 120 dated 17 December 1883, he initiated steps to introduce a State Life Insurance scheme for postal employees.

Postal Life Insurance was formally launched on 1 February 1884, with the approval of the Secretary of State for India under the authority of the Queen Empress of India. Initially meant for postal employees, the scheme was extended to:

- Telegraph Department employees in 1888

- Female employees of the P&T Department in 1894 — at a time when private insurers did not cover women

Expansion and Coverage

From a few hundred policies in 1884, PLI has grown to cover lakhs of policyholders. Today, it provides insurance coverage to:

- Central and State Government employees

- Public Sector Undertakings

- Universities and Government-aided institutions

- Nationalized Banks

- Local Bodies

- Defence and Para-military personnel

It also introduced Rural Postal Life Insurance (RPLI) for rural populations and Gramin Dak Sevaks.

As of 31 March 2008:

- Over 35 lakh PLI policies with a sum assured of ₹31,469 crores

- Over 61 lakh RPLI policies with a sum assured of ₹41,846 crores

- PLI corpus: ₹12,081.71 crores

- RPLI corpus: ₹3,003.78 crores

These figures reflect remarkable growth and public trust.

Insurance Plans Offered

PLI and RPLI offer multiple insurance products, including:

- Whole Life Assurance (Suraksha)

- Convertible Whole Life Assurance (Suvidha)

- Endowment Assurance (Santosh)

- Anticipated Endowment Assurance (Sumangal / Grama Sumangal)

- Grama Suraksha

- Grama Priya

PLI operates as an exempted insurer under Section 118 of the Insurance Act, 1938 and Section 44(d) of the LIC Act, 1956.

Unique Features

- Self-financing scheme managed by the Department of Posts

- Low premium with high bonus returns

- Coverage of all risks (including war, accident, and suicide) without extra charge once policy is issued

- Operates through India’s vast postal network, minimizing administrative costs

The Director General (Posts) serves as the Administrator of both PLI and RPLI funds.

Legacy of 125 Years

For over a century, Postal Life Insurance has upheld its motto of “Insuring lives and ensuring smiles.” By offering affordable and reliable life insurance to government employees and rural citizens, it has played a significant role in India’s social security framework.

In recognition of its 125 years of dedicated service, the Department of Posts issued a commemorative postage stamp, celebrating the enduring contribution of Postal Life Insurance to the nation’s welfare.

First Day Cover

Leave a Comment

You must be logged in to post a comment.