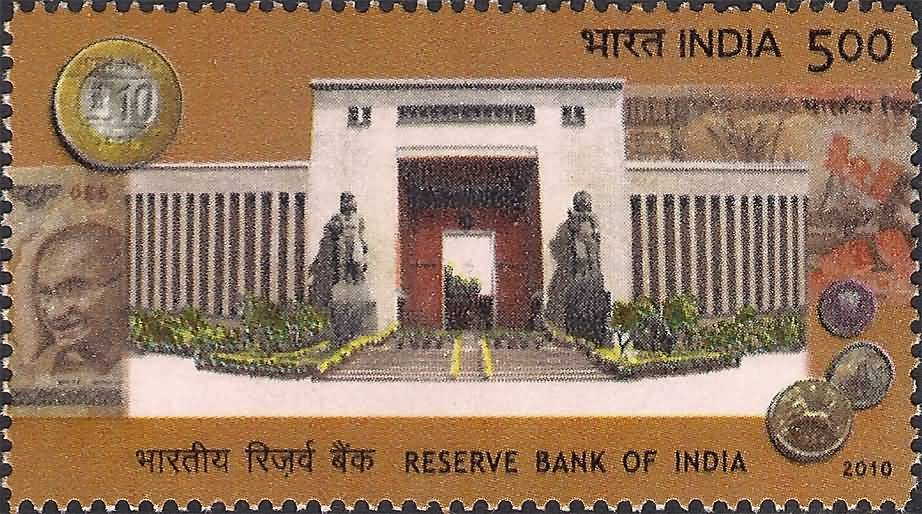

Reserve Bank of India

Technical Data

| Date of Issue | January 16, 2010 |

|---|---|

| Denomination | Rs. 5 |

| Quantity | 800,000 |

| Perforation | 13 |

| Printer | India Security Press, Nasik |

| Printing Process | Wet Offset |

| Watermark | No Watermark |

| Colors | Multicolor |

| Credit (Designed By) | Sh. Sankha Samanta |

| Catalog Codes |

Michel IN 2457 Stamp Number IN 2395 Yvert et Tellier IN 2220 Stanley Gibbons IN 2685 WADP Numbering System - WNS IN002.2010 |

| Themes | Anniversaries and Jubilees | Banks | Buildings | Coins |

Decades of Monetary Excellence

Established on April 1, 1935, the Reserve Bank of India (RBI) stands as the backbone of the nation’s financial architecture. Originally created to unify the powers of the Government’s Currency Department and the Imperial Bank of India, the RBI was designed to pool monetary reserves and deploy them strategically to fuel the Indian economy.

The Core Mission of the RBI

From its inception, the RBI’s primary mandate has been to:

- Regulate Banknotes: Overseeing the issuance and supply of currency.

- Secure Monetary Stability: Maintaining essential reserves to protect the value of the Rupee.

- Manage Credit & Currency: Operating the national credit system to the country’s best advantage.

Modern Focus Areas: Beyond Currency

Today, the RBI’s role has evolved into a multifaceted mission that impacts every citizen. Its major focus areas include:

- Monetary Stability: Conducting policies that promote sustainable, long-term economic growth.

- Financial Supervision: Ensuring a safe, competitive, and accessible banking system that provides adequate credit to all sectors.

- Payment Systems: Managing the integrity and efficiency of retail and systemic payment infrastructures.

- Government Services: Acting as the primary banker and debt manager for the Government of India.

- Market Development: Building institutions and deepening financial markets to create a robust economic environment.

- Economic Advisory: Providing vital data on banking, finance, and Balance of Payments (BoP) statistics to advise the government on critical issues.

A Growing National Footprint

The RBI follows an “incremental approach” to expansion, opening offices as regional needs arise. This decentralization ensures the bank can engage with local development processes directly.

Notably, the opening of offices in states like Chhattisgarh, Jharkhand, and Uttarakhand highlights the RBI’s commitment to ensuring the financial concerns of vulnerable and marginalized groups are heard and addressed.

Infrastructure and Heritage

With a workforce of approximately 21,000 employees, the RBI operates through a quasi-federal structure:

- Central Office: Located in Mumbai, housing 26 specialized departments.

- Regional Reach: 29 offices spread across India, primarily in state capitals.

The RBI’s physical presence tells a story of progress—from its first headquarters on Council House Street in Kolkata to its iconic modern towers in Mumbai. Even its Delhi office bridges history and myth, featuring the famous Yaksha and Yakshini statues standing guard at the entrance.

Commemorating a Legacy

In recognition of its pivotal role in shaping the nation’s economy and its journey into its 75th year (and beyond), the Department of Posts is proud to honor the Reserve Bank of India with a commemorative postage stamp.

First Day Cover

Leave a Comment

You must be logged in to post a comment.