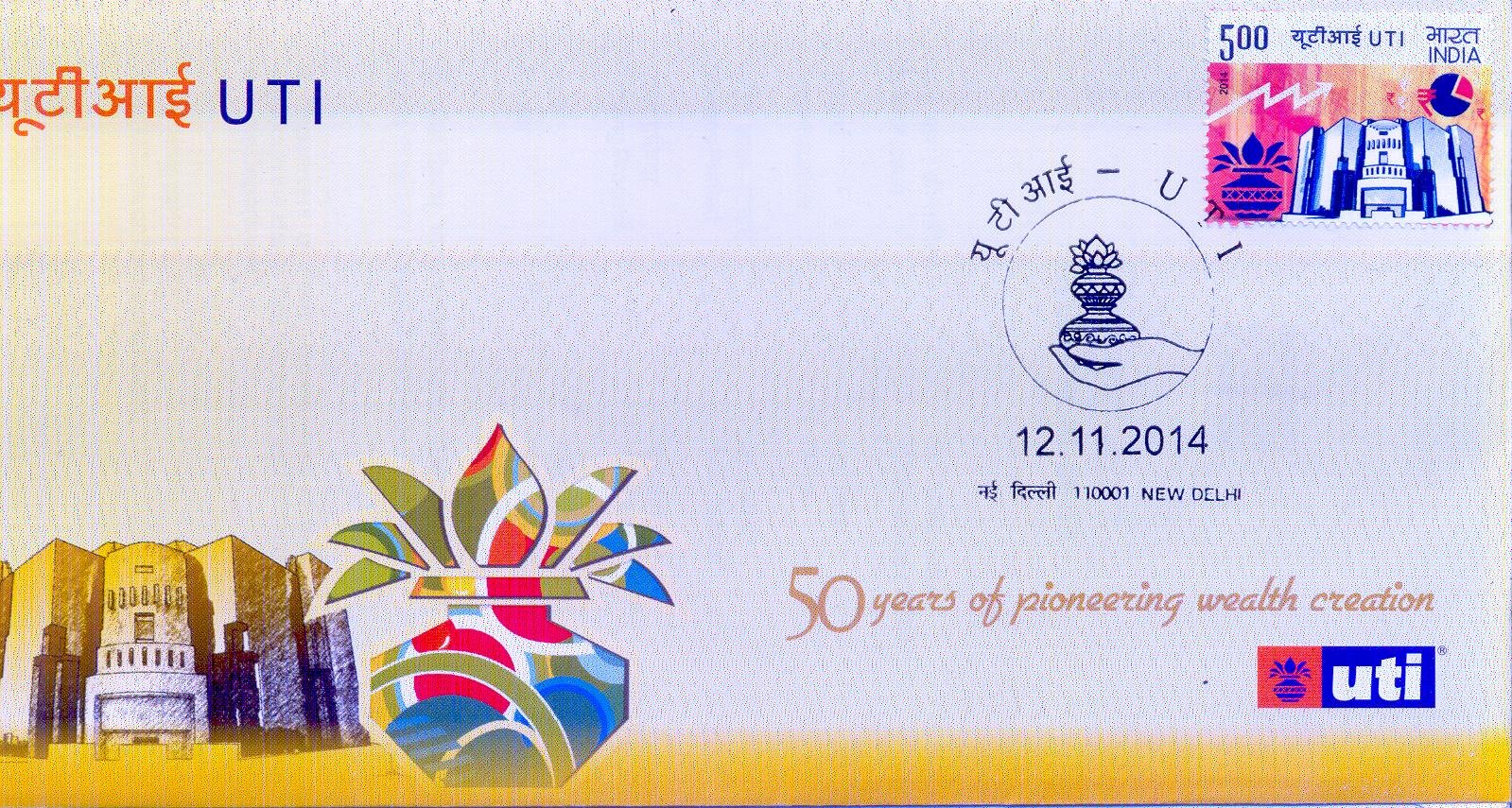

50th Anniversary of Unit Trust of India (UTI)

Technical Data

| Date of Issue | November 12, 2014 |

|---|---|

| Denomination | Rs. 5 |

| Quantity | 4,030,000 |

| Perforation | 13½ |

| Printer | Security Printing Press, Hyderabad |

| Printing Process | Wet Offset |

| Watermark | No Watermark |

| Colors | Multicolor |

| Credit (Designed By) | Shri Kamleshwar Singh Smt. Alka Sharma |

| Catalog Codes |

Michel IN 2850 Yvert et Tellier IN 2594 Stanley Gibbons IN 3023 |

| Themes | Anniversaries and Jubilees | Buildings | Finance |

Pioneer of Mutual Fund Movement in India

Foundation of India’s Development Vision

India’s post-Independence development strategy aimed to build a socialistic pattern of society rooted in economic growth, self-reliance, social justice and poverty alleviation. These goals were pursued within a democratic polity through a mixed economy, where both public and private sectors functioned side by side.

During the 1960s—an era of rapid industrialisation and the Green Revolution—policy makers emphasized the need for regulatory mechanisms such as licensing, investment allocation and state-directed industrial planning. It was within this framework that the Unit Trust of India (UTI) was established under the Unit Trust of India Act, 1963.

Establishment and Early Years

UTI was set up by the Reserve Bank of India (RBI) and functioned under its regulatory and administrative supervision. The institution formally began operations on 1 February 1964, with a clear objective:

- To mobilise the savings of the community, and

- To give small investors a means of participating in the nation’s industrial growth.

The organisation’s first and most iconic offering was Unit Scheme 64 (US-64), which soon became one of the largest investment schemes of its time.

In 1978, UTI was delinked from the RBI and brought under the regulatory and administrative charge of the Industrial Development Bank of India (IDBI).

Growth, Monopoly, and Transition

For more than two decades, UTI remained the only institutional vehicle for investment in India’s capital market. Over time, public sector banks were allowed to introduce their own schemes, paving the way for competition. The establishment of the Securities and Exchange Board of India (SEBI) further energised the sector by introducing systematic regulation.

In 2001, the Unit Trust of India Act, 1963 was repealed. This significant transition resulted in the bifurcation of UTI into two distinct entities on 1 February 2003:

- Specified Undertaking of the Unit Trust of India (SUUTI)

- UTI Mutual Fund (UTIMF)

Specified Undertaking of UTI (SUUTI)

SUUTI inherited assets worth ₹29,835 crore as of January 2003. These largely comprised:

- US-64 scheme

- Assured return schemes

- Certain legacy schemes of the pre-2003 UTI

SUUTI functions under an independent administrator appointed by the Government of India and does not fall under SEBI’s Mutual Fund Regulations.

UTI Mutual Fund: A New Era

The second branch—UTI Mutual Fund—was established in compliance with SEBI’s Mutual Fund Regulations. It is jointly sponsored by:

- State Bank of India

- Punjab National Bank

- Bank of Baroda

- Life Insurance Corporation of India

Each sponsor holds 18.5% stake in the paid-up capital of UTI Asset Management Company (UTI AMC).

With the restructuring of the erstwhile UTI, which managed over ₹76,000 crore in March 2000, the Indian mutual fund industry moved towards greater transparency, competition, consolidation, and rapid growth.

Legacy and Contributions

UTI is not only the oldest but also one of the largest mutual fund institutions in the country. Over the years, it introduced several innovative schemes, including:

- UTI Unit Linked Insurance Plan (ULIP) in 1971, offering life and accident insurance along with investment benefits.

As a brand, UTI has played the role of a wealth creator for millions of Indians. It is recognized as a process-driven, customer-centric financial institution committed to consistency, trust, and excellence.

Philatelic Honour

To honour its pioneering role in India’s financial sector, a commemorative postage stamp on Unit Trust of India (UTI) was issued, symbolizing its remarkable contributions to the nation’s economic landscape and to generations of Indian investors.

First Day Cover

Leave a Comment

You must be logged in to post a comment.